Altisource is a storied company that was part of the Bill Erbey complex (see this Forbes write-up) arising from the Great Financial Crisis. Right now, it is more or less a play on a set of 2 lawsuits- the most important of which is active in the New York Supreme Court. Last fall, Thomas Braziel and I discussed $AAMC with Andrew Walker at Yet Another Value Blog.

More or less, the story at the time was that lawsuits concerning the company's preferred stock were getting settled, and the remaining suit should as well. What would remain is a cash box with acquisitions coming in the alternative lending or crypto space. To this end, sound executives were coming on board and even MOVING to the US Virgin Islands. People generally don't pick up and move for something going bankrupt because of lawsuits. The basic math at the time was that the shares were trading in the mid to high 20s with a book value of a similar amount. A settlement could happen with the lawsuit, or there could be a business acquisition, and the stock could rip because it has a less than large float.

_____

>>>>Fast forward to today>>>>

_____

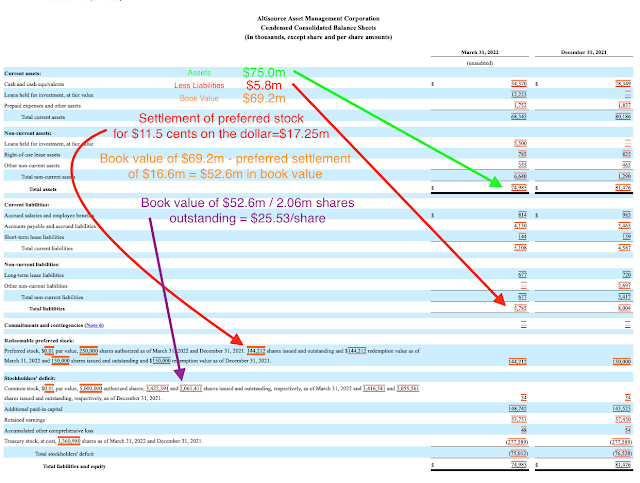

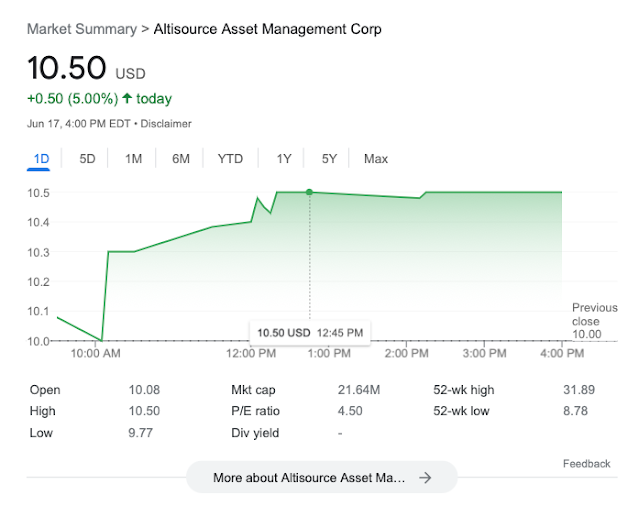

In my mind- the workout value of the company is ~$25/share vs. a current share price of $10.50- this gives no value to the business the company is developing in the lending space.

There have been a few developments, and generally, I think that the catalysts are getting closer.

While the price of AAMC's stock has come down by more than 1/2, the story has not substantially changed. In my mind, that makes it a better deal with more of a margin of safety. As recently as last week and in the prior months, I have been adding to my position.

Here are the highlights.

*New Leadership at the company has me optimistic for its future. Jason Kopack began with the company in mid-May 2022 and has a storied past in the mortgage business. With former CEO Thomas McCarthy leaving the company (he had been interim CEO, so no surprise there), the company's strategic direction seems clear. This is nearly a pure-play alternative lending business that may also pursue a limited opportunity in Crypto ATMs with Forum Pay. In their investor presentation, the company expects ROEs on the crypto ATMs of 40%- if they can, then more power to them! Right now, this is a small aspect of the potential business and only has a commitment of $2 million dollars. For my valuation, I don't ascribe value to the crypto play other than getting it as a free call option.

*NYSE trading suspension- the NYSE suspended the company's trading on November 30, 2021. However, the issues with not having an operating business were fixed, and the company's stock resumed trading in March of 2022. More on this later in this write-up.

*More settlements with preferred stockholders have culminated- while not massive amounts, in January of 2022, some more minor preferred stockholders settled.

"Altisource Asset Management Corporation (“AAMC” or the “Company”) (NYSE American: AAMC) today announced that it had entered into a settlement agreement (the “Settlement Agreement”) with two institutional investors related to the Company’s Series A Convertible Preferred Stock (the “Series A Shares”). Under the Settlement Agreement, the Company has agreed to pay the institutional investors approximately$665 thousand in cash in exchange for$5.79 million of liquidation preference of the Company’s Series A Shares (11.5 cents per dollar liquidation amount of the Series A Shares). As a result of this settlement, the Company estimates that it will recognize a gain of approximately$5.1 million to additional paid in capital in the first quarter of 2022. The resulting outstanding remaining liquidation preference of Series A Shares will be approximately$144.2 million , which represents the entire Luxor Funds position."

The terms are relatively similar to the settlement with Putnam in February of 2021.

*Potential de-listing from the NYSE. On June 3rd, 2022, Altisource disclosed that the company received a deficiency letter from the NYSE. However, the company will submit a plan to eventually comply with the listing standards by June 30th. This may give them until November 30, 2023, to come into full compliance. Even if the NYSE doesn't accept the plan or the company fails to complete it, the shares will trade OTC- hardly the world's end.

Here is a PDF where the NYSE talks about its listing standards.

*Insider purchases of stock to the tune of just under 10,000 shares. While not a tremendous amount (roughly $100K dollars), it is interesting to see the timing of the investments. These purchases happened on April 25th, 2022 (see pic), and were disclosed in this press release on April 27th, 2022.

Before these purchases, on April 22nd, the company released financial results and disclosed the following without much detail being given (underline mine):

The Company intends to bring a lawsuit against our former director,

Nathaniel Redleaf , andLuxor Capital Group, LP and certain of its funds and managed accounts (collectively, “Luxor”), for among other things, breach of fiduciary duty, aiding and abetting breach of fiduciary duty, and breach of contract. The Company has taken steps to facilitate the filing of this lawsuit.

On April 29th, the company issued this bomb of a letter to the Judge in the New York Supreme Court case. In the letter, they wrote (underline Judge:

AAMC learned through discovery in this case that Mr. Redleaf repeatedly disclosed AAMC’s confidential information to his colleagues at Luxor who were managing a position in AAMC’s common stock of more than $200 million. The documents listed in Attachment A establish this conduct and show that Plaintiffs were trading in AAMC’s common stock while in possession of this information. AAMC intends to pursue claims arising out of Mr. Redleaf’s breach of his fiduciary duties. In addition, two of the documents on Attachment A relate to Luxor’s bad faith conduct that potentially gives rise to a contract claim. Moreover, these documents may be relevant to respond to any equitable arguments that Plaintiffs may raise in this case.

One of my favorite Twitter accounts is @NonGaap. While he has not been super active as of late, he regularly discusses incentives and how often disclosures are done so that members of the board or management can benefit. From my peJudgetive, this could have happened given the timing of the disclosures and purchases. See below for a highlight of the dates.

Friday, April 22, the company discloses they are bringing suit against a former director, Nathaniel Redleaf, for breach of fiduciary duty.

On Monday, April 25th, insiders purchase just under 10,000 shares of $AAMC stock for around $100K.

Friday, April 29th, the company issued a letter to the Judge in the Luxor trial that seems to imply that the former director gave inside information to the Luxor. Not only that but Luxor, who is in a legal dispute, traded while in possession of that information...

While the judge would not let the company disclose the documents immediately, my reading is that the company can use them as part of its Summary Judgment Arguments. Those arguments will be submitted on or before July 19th, 2022.

*Allegations of insider trading and breach of fiduciary duty seem to provide Luxor with a solid incentive to settle the legal dispute with Altisource. See below for the letter concerning the emails that AAMC dug up in discovery.

_____

Why does this opportunity exist?

In my mind, the considerable selloff in shares of AAMC was due to investor exhaustion from the trading suspension that began on November 30th, 2022. The issues with not having an operating business were resolved with this press release on March 18, 2022. Because the company took action to form an alternative lending group, trading of Altisource's stock resumed on March 21, 2022. Imagine a shareholder base that couldn't buy or sell its stock for nearly 4 months... On the face of things, you would be pretty perturbed. I know that I wasn't exactly thrilled. Joshua Horowitz, a company shareholder who owns ~2% of shares outstanding, even filed a proxy expressing his frustration!

Something to keep in mind- it was evident that the company didn't have an operating business. It was apparent that they didn't have one for an extended period. The NYSE makes its listing requirements public- so should this suspension have been a shock? Probably not- however, I will admit, I was taken a little bit off guard.

Regardless, the company worked to solve the problem. They even responded to the proxy from Mr. Horowitz rather than using the defense of an ostrich sticking its head in the sand, as many smaller companies tend to do. To me- the company's response and efforts to (successfully) fix these issues are about all that can be asked for. They now have an operating business- and it is one that I like! It seems to be relatively similar to Sachem Capital ($SACH), a lender where I owned both the equity and the baby bonds in 2020.

In my mind, the other (and primary) reason for the lagging share price is the lack of a settlement with Luxor concerning the redemptions of the company's preferred stock- as such, let's look at the Luxor suit.

In March 2014, several parties gave AAMC $250 million in cash for $250 thousand preferred shares that come due in 2044 and yield 0% interest. As you can imagine, the present value of something due nearly 2 decades from today yielding nothing (literally, NOTHING) is not worth a lot. An income security becomes worth less in a rising rate environment when the discount rate increases. Additionally, rising rates typically mean good outcomes for alternative lenders.

In March 2020, several preferred holders wanted to redeem their preferred stock. Luxor delivered a redemption notice to AAMC in late January 2020, saying so much.

The only problem was that Altisource didn’t have the legally available funds. There were ~$144 million in preferred redemptions to Luxor alone. This was when the company had ~$16.7 million in cash and only $49 million in assets as per its 10Q for the period ending on March 31st, 2020. The preferred share agreement clearly states that the preferreds only need to be redeemed in FULL. They refused to pay any preferred holders because AAMC was losing money and only had a fraction of the legally available funds. For quick reference- here is the definition of "legally available funds" from Law Insider:

Legally Available Funds means, as of any determination date, an amount equal to the aggregate gross asset value of the Fund as of such date, minus the sum as of such date of (i) the liabilities of the Fund, and (ii) the amount that would be needed, if the Fundwere to be dissolved at the time of the Payment, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving such Payment; provided that no Payment shall be deemed to be made from “Legally Available Funds” if, after giving effect to such Payment, the Fund would be unable to pay its existing and reasonably foreseeable debts, liabilities and obligations, whether or not liquidated, matured, asserted or contingent, as they become due in the usual course of business.

See below for the original complaint from Luxor. You can also access the file on the New York Supreme Court site.

Luxor’s boiled-down argument seems that the company should have redeemed PART of the preferred shares.

To me, Luxor's argument seems to go directly against the language in the preferred documents. Ironically, the law firm representing Luxor (Akin Gump) also drafted the preferred share purchase agreement. I have spoken with several attorneys, who indicated that the document was sloppy, at best.

Here is the language in the preferred document from the 8K regarding the issuance:

Per the company's 10Q- AAMC is required to pay back the preferred stock holders out of funds legally available and is required to do so in the redemption of all, but not less than all of the issuance (see highlights).

As we move on in the trial, it seems that Luxor has stalled and held things up but a recently agreed to Joint Stipulation And Order that seems to have a Summary Judgement date more "set in stone" as all discovery is not finished. Check out the docket for yourself: As of now, it appears that summary judgment motions will be submitted on or before July 29th, 2022.

It seems customary for legal spats such as the one that Luxor and AAMC are in to settle right before they go to trial. Though, the allegations of breach of fiduciary duty and potentially trading of securities involved trading while possessing what seems to be material non-public information... That revelation seems that it could change the arithmetic of the case and cause a settlement before summary judgment arguments are submitted. If I was Mr. Redleaf or Luxor, I would very much so want this to be out of the public eye. The incriminating evidence seems to originate from emails found in discovery and can be part of the summary judgment arguments by AAMC. A settlement in the next month would help keep Luxor from getting some serious egg on its face. But who really knows- it seems that Luxor's preferred shares of AAMC are being held in a special purpose vehicle... so we will see.

_______

Moving on to the business side of things.

This Investor Presentation (see PDF below) was also beneficial for the company is laying out its vision for the future.

In terms of action Altisource has taken, we can see the following on the operations side: the mortgage lending business seems to be humming along- more commitments, more loans under evaluation, and the company also recently hired a new head of sales. This should help them originate and sell high-yielding loans, which will generate more income for the company than just investing for yield with the loans that AAMC chooses to keep on their books. Another item that I found interesting is that the company can utilize its staff already employed in India for the mortgage business. While the new sales hires and such will affect margins, expenses for the new business won't seem as bad as they could have, given that the company was already employing some workforce.

Highlights that I found to be highlights of the presentation:

-Secure Lines of Credit to leverage the initial capital commitment of up to $40 million to create origination/purchase capacity of $100+ million.

-ROE for the Alternative Lending Origination Platform after 120 days: Target 30%+

-ROE for Assets held on balance sheet: Target 12-15%

-An origination team is expected to be in place within 60-90 days and shortly thereafter it is assumed that loan origination volume will exceed $50 million a month

Please note that the company is trading substantially BELOW boot value (less than 50% in my estimate), so these returns will essentially be doubled concerning the company's current market cap.

Back of the envelope workout value, based on the numbers of their last 10Q:

YES... I know that I rounded; I know that there will be future litigation expenses; I know there will be SG&A; I know they could settle with Luxor for MORE than 11.5 cents on the dollar or not at all; I know that AAMC could even issue stock to Luxor as part of a settlement; I know they have acquired loans that are bearing interest... However, I will assume that the interim interest from the loans will make the company break even in the quarter and that going forward, the return metrics will start to look pretty decent. After all, with this "adjusted" book value of $25.53/share, with the share price currently at $10.50/share and a market cap of $21.64 million- it doesn't take a whole lot of loan origination and sales to make this thing really hum when they think they can get loan originations to over $100 million.

I think that the fundamental uniqueness of the alternative lending business will shine in the interest rate environment that the country seems to be entering. When numerous lending institutions make loans harder to get as they begin to fear a recession, lenders generally just deny loans rather than increase the loan's interest rate to reduce demand for their product (here, here, and here). That is the situation in which a company like Altisource can come in and provide loans to real estate investors and the like at double-digit interest rates for a spectacular return. What will be really interesting is if the company can raise capital in a way similar to Manhattan Bridge Capital or Sachem Capital. My bet is that the answer will be "yes." AAMC already has a more impressive balance sheet than Manhattan Bridge Capital ($LOAN), and Sachem Capital has grown its balance sheet with the issuance of more than a handful of "baby bond" offerings. Sachem has even made issuances for OVER allotments! I see no reason why $AAMC will be unable to do this.

In the meantime... We wait. I certainly like the dynamics of a cash box that is turning into a lending entity. This has exciting dynamics given the current rate environment and even has the potential to offer returns that are not correlated to the broader market.

Sure, there is the risk associated with the lawsuit- however, I do not see how this would take the company to zero given the wording of the documents- "legally available funds" is pretty straightforward, and I feel comfortable investing in this. I generally think that there will be a settlement with Luxor in the next month before Summary Judgement arguments are due or in the month before oral arguments are heard by a judge on December 1, 2022.

EVEN IF the Luxor lawsuit ends up not getting resolved, Altisource will be able to lend more funds out and continue growing the business while the preferred stock receives a 0% yield until 2044. Given that the market is absolutely freaking out about interest rates- I can think of many less bad things than having a 0% fixed loan for the next 2 decades...

Disclosure: I own shares of AAMC.

No comments:

Post a Comment