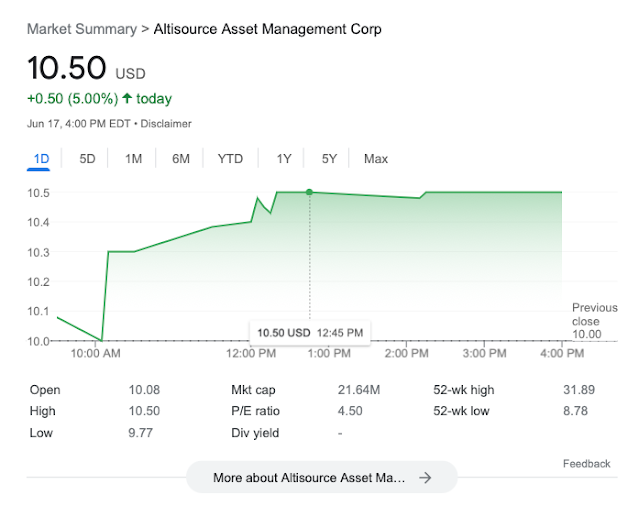

In my last writeup, I discussed how Altisource Asset Management ($AAMC) seemed like an attractive investment because of its discount to an adjusted book value of ~$25/share compared to the then price of ~$10.50/share. I thought that it was probable that the company would settle a preferred stock lawsuit that would be a catalyst, but didn't give much mind to the lending business that the company was getting up and running. Since the stock is now trading at ~$20/share and it has been about 5 months since that writeup, that begs the question: "what has happened in the way of developments at the company?!"

Well, quite a lot!

First, it has oral arguments for summary judgment against Luxor this coming Thursday, December 1st at 11AM...

Other than that, it is VERY impressive what the company has achieved in just the last 5 months since appointing Jason Kopack as CEO. Jason is THE guy in the alternative lending space and has an excellent resume. I cannot think of anyone better than he to lead Altisource. Because of Kopack coming on-board, I am very excited about the company's future.

Here is a summary of points that I will then break down into greater detail later in this writeup:

1) Established its lending business that has generated over $120 million of loans (and already received payoffs!)

2) Established a $50 million warehouse line with Flagstar Bank to assist the growth of its origination platform

3) Progressed in its litigation against Luxor and former Luxor appointee to AAMC’s board, Nathaniel Redleaf, with summary judgment arguments happening this Thursday, December 1st at 11AM. 2022. If you want to watch the oral arguments, DM me on Twitter, and I will forward you the Microsoft Teams link to watch. Here is the link to my Twitter.

4) Repurchased ~14% of shares outstanding and eliminated a most favored nations agreement overhang

5) Worked with the NYSE to get in compliance with the exchange's listing standards

6) Launched a new website reflecting all of these changes: https://www.altisourceamc.com/

7) Valuation: Probably VERY undervalued, with catalysts, and the company can reasonably earn $10/share (on a ~$20 current stock price)

If you want to get some of this info directly from the horse's mouth, I strongly suggest you check out this presentation paired with this recent company conference call. It is worth a listen while you are driving or exercising. If reading a transcript is more your speed, it is from Seeking Alpha.

______

Lending Business Is Drinking From A Firehose: Altisource has come a long way to establishing its mortgage origination platform. It originates loans on single and multifamily housing for developers and then sells those loans to institutional investors. There are a few public lenders in this space- Manhattan Bridge Capital ($LOAN), Broadmark ($BRMK), and Sachem Capital ($SACH). Previously, I have written up and owned the stock and bonds of Sachem.

Note that Altisource has a DIFFERENT process from many other lenders in this space such as Manhattan Bridge Capital (check out this presentation) and Sachem Capital (see their presentation). Whereas these companies originate and keep the loans on their books, Altisource originates the loans and then sells them, collecting income from the sale and interest rate share. Currently, AAMC is establishing forward sales contracts to produce consistent and, more importantly, predictable cash flows. These forward sales contracts will also allow the company to anticipate the volume of loans that they need to originate. The end buyers for these originated assets are varied- credit funds, banks, REITs, and insurance companies are some examples of institutions in the market for these high-yielding instruments.

Per this presentation, these take the form of Correspondent, Wholesale, and Direct to Borrower originations. The company typically does Debt Service Coverage Ratio (DSCR) or Bridge Loans. DSCR loans are more or less a form of permanent financing for rental properties. In contrast, bridge loans allow investors to quickly purchase, renovate, and stabilize an investment property before they sell the property or establish permanent financing. Bridge loans carry a higher interest rate than DSCR because they typically carry more risk than a stabilized rental home with tenants living in it. Below is a tweet where some investors talk about how they have successfully used DSCR loans to build a portfolio. Additionally, here is an article on DSCR loans.

Bridge loans are attractive because they allow investors to close on a property quickly when it needs work and likely has tenant and maintenance issues.

Here is a link to a Twitter thread from a hard money lender

named Bob Flynn that explains how bridge loans (also called hard money loans) work.

Regarding research and scuttlebutt on the company's products- I have used the company’s loan products for 2 rental properties I own. One is a DSCR loan- it’s a loan that was done at 70% LTV on a 30-year fixed note at ~8.75% interest. That is more than I would have paid in interest at a bank (then 6.5%, now 7.25%)- but I wanted to test the product. Plus, banks in my market will not originate 30-year fixed mortgages for investors. Something to consider is that if you amortize a loan over 30 years rather than 20, (which is pretty standard for banks here in Central KY), the difference in payment is roughly equivalent to 1.5% in additional interest- so the difference in monthly payment is basically non-existent- though, total payments over the life of the loan are significantly more. Something that does offset that is that The extra interest expense gives you better tax treatment relative to your cash flow, which keeps more money in your pocket in the early years of the loan.

Because of this, it can be pretty rational for an investor to pay a higher rate for AAMC’s product. Just knowing that your payment will never change can be very nice. As an example- earlier in the year, I got some 30 year fixed loans at 6.5%- while that was a high rate at the time- it comparably looks pretty good now!

If you want to see some specifics of the house I received a loan on so that you can see the collateral that AAMC has- check out the series of tweets below- it even has some Matterports $MTTR of the house- so you can virtually walk through it!

I also have a bridge loan scheduled to close this Tuesday (11/30/22) on a 4 plex that I paid ~$65K for, and I plan to invest ~$300K in the renovation of. Once stabilized, the building should rent for in excess of $3,600/mo. For this, Altisource is financing 70% of the purchase price and will reimburse a majority of the construction funds I pay out once they are verified via inspection. The setup is very similar to a standard construction loan that a bank does. Once the property is stabilized and rented, I can refinance the property through Altisource or another lender- I could also sell the property to another investor. I think that the building will be worth a little more than $400K when completed, and at the end, Altisource will have a mortgage on the property with a balance of less than $300K. This strikes me as a safe loan for them.

The process for applying for both of these loans was pretty straightforward. You can see the start of the origination process at https://altlendinggroup.com. From there, I dealt with a contact at the company for coordinating closing, title work, appraisal, and the like. The company does a significant amount of verification regarding a borrower, and is mainly concerned with credit score, number of successful exits in real estate deals, as well as lease status and Loan To Value of the subject property. And of course- if the rent will cover the debt payments on the property.

The timing of the company rolling out this product is pretty much perfect given the current conditions of the real estate market. Below is a tweet from Jeff Feldman who is a real estate financier, referencing the strong demand in the industry for the products similar to the ones that Altisource offers- there are over 200 of them!

Perhaps the most exciting about the product that the company is rolling out is that it is a business that has already been folded into a public company several times over the last few years. Redwood Trust $RWT has acquired several companies in this space. Corevest alone went for nearly half a BILLION dollars compared to Altisource's current market cap of ~$35 million. Below is a link to a tweet where I discuss the specifics of these tuck-in acquisitions for Redwood. I will do my best to add to these threads in the future if there are any developments of mention. Note- the acquisitions were for companies doing originations in line with the volumes that $AAMC thinks it can do. The buyout prices were many multiples of Altisource's current market cap of $35 million.

In terms of yearly origination volumes, Jason Kopcak, AAMC's CEO, has stated that the company will be able to do more than $600 million in loan originations. How realistic is that? In the market the company is in, I believe that it is very achievable. Mr Kopcak said on the company's most recent conference call that the market for DSCR loans is likely in the trillions of dollars and that the market for bridge financing being in the hundreds of billions of dollars. For a sanity check, Corevest, on its homepage, claims to have originated over $20 BILLION in loans... This is for a company established in 2014. $20 billion in 8 years...

For even more of a sanity check, see the tweet below, where Kiavi has averaged doing well more than a billion dollars of lending per year. Kind of interesting that Kiavi had done an average of more than a billion a year in lending. $AAMC has the goal of just doing $600 million... 🤔

Also, below is a Twitter thread where I discussed several items on the previously referenced conference call.

The bottom line is that it seems very plausible that Altisource can achieve $600 million in originations in short order. This is especially true as they produced more than $123 million in loan commitments as of September 30th... As of June 30th, they had $31 million... so the math certainly checks out.

New Warehouse Line Of Credit: To aid the growth of the origination business, the company opened a $50 million warehouse line with Flagstar Bank ($FBC) (the bank recently granted the amount going up to $52.5 million). A warehouse line is a loan secured by mortgages that the company originates. In its most recent conference call, the company also said that it is looking to establish a more extensive borrowing base to grow its alternative lending business. A valid concern is that some companies can get in trouble with these lines of credit and insufficient collateral if underwriting is sloppy and they are caught in a down market. I don't think that is too much of a worry with Altisource for several reasons. First, the company has a LOT of collateral- at the end of Q3, total loans outstanding were nearly $100 million. So, the company could see the value of their loans being SIGNIFICANTLY impaired and still be okay. I don't think there is any worry about a capital call, here.

Per the company's most recent conference call, AAMC is also looking at other funding options. The type of equity the company has should provide a nice buffer for this additional leverage, especially considering that they have become more conservative in their underwriting in terms of Loan To Value ratios. Consider that the collateral for the $52.5 million warehouse facility is $62 million in loans. This means that the company could easily use its reserves of ~$38 million in loans to fund more borrowing. While I doubt the company would do this as much as possible at the moment, hypothetically, this could support another $150 million in warehouse lines under the same terms as Flagstar's current debt facility. Even more once AAMC has a few profitable quarters under its belt.

Given this, it would take a VERY significant housing correction for the company to default on its debt covenants. Currently, the warehouse line has $52.5 million drawn against it and $62 million of collateral. Now keep in mind- the collateral are loans that are at 70% or so LTV, so the appraised value of the real estate that AAMC has a mortgage against is likely around $90 million... Even in the extremes of the Great Recession- real estate prices nationally didn't decline by nearly the 40% that would need to happen for the company to come up with more collateral for its warehouse line. In fact, national real estate prices went down by 33% during a time when people were literally questioning if it was the end of the financial world. So, in terms of stress testing the loans and the debt facility that AAMC currently has- I am not too worried.

An interesting side point is that a housing correction could be a boon for AAMC. As a hypothetical: in our collective lifetimes, when would the BEST time to have started a bank have been? Without a doubt, it would have been in 2008/2009 when every other bank was imploding. When you could start with a fresh loan book that would be full of loans at LTVs that were not only lower than had previously been offered but were also based on values that had been adjusted down because of falling real estate prices and your conservative underwriting. Beal Bank used this exact sort of playbook in the 2000s.

Take a look at what is going on at Broadmark... They seem to be getting more conservative and preserving capital. Given the recent share price declines that reflect that the company has nearly $300 million of loans in some sort of default, there could be a situation where Broadmark would start selling loans. Now, combine that with the AAMC underwriting team's history, where they underwrote BILLIONS of dollars worth of real estate deals for Front Yard Residential before it got bought out. Specifically, the team led the acquisition of over 14,000 single-family residences and over 4.1 BILLION in non-preforming mortgages and REOs. That is pretty darn impressive for a company with a current market cap of ~$35 million!

Is it possible that AAMC could purchase underwater loans from forced sellers (maybe Broadmark or similar operators?), work with borrowers to stabilize and modify the loans, then sell them back to the market? I think that there is a non-zero chance of that happening- but more importantly, this illustrates the type of things a clean company can do when entering a troubled market with lots of participants closing their doors.

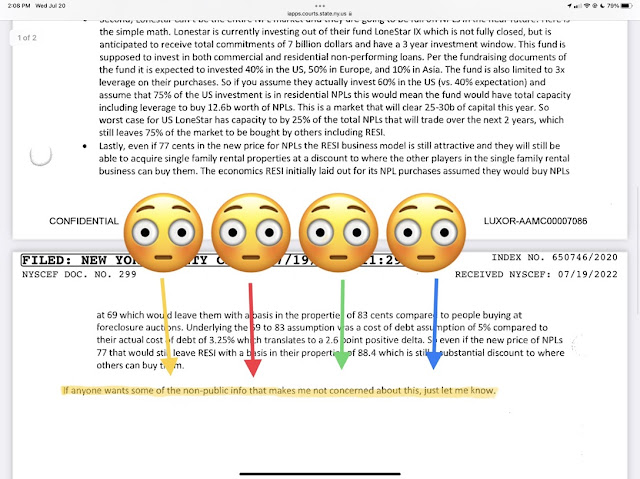

Progress In Preferred Stock Litigation: As part of the ongoing preferred stock lawsuit with Luxor, motions for summary judgment were filed in the New York Supreme Court on July 19th.

In those motions, there were pieces of discovery included as exhibits that included some pretty damning items against Luxor. These took the form of emails where Luxor Executives in not so many words implied that they could not redeem PART of their preferred shares- which is what the whole case is about. There were also emails that came out where a Luxor appointee to AAMC's board of directors was sharing material non-public info.

Oral arguments for summary judgment are scheduled for December 1st, 2022. If you want to watch the oral arguments, DM me on Twitter, and I will forward you the Microsoft Teams link to watch. See below for the link.

In my last write-up, I thought there was a strong possibility of there being a settlement before the trial- that appears to have not played out. However, the legal arithmetic has changed. We now have more clarity on the emails that came out in discovery from the former AAMC director (and Luxor appointee) to his colleagues.

Here is a link to a thread on Twitter where I look at some of the items that came out in the Luxor v AAMC suit.

These are severe charges, and there are

literally emails that were discovered where the former director was giving away tons of material non-public info and then typed, "If anyone wants some of the non-public info that makes me not concerned about this, just let me know." There were multiple instances of this, and one would think Luxor wouldn't want these emails in the public domain for many reasons...

Going forward, I think that it is reasonably likely that there will be some sort of settlement. One point is that these preferred shares are in a

special purpose investment vehicle that is in wind-down mode. As a plus for AAMC, a bonus from the Putnam repurchase, there is no longer a "most favored nations clause," meaning that AAMC could settle with Luxor for more than they did with other claimants, and Altisource wouldn't have to pay any of the additional settlement to Putnam. Though, I think it is fairly likely that the company could settle for less than previous amounts because the net present value of the preferred stock is worth less today than it was a year ago. Given that the discount rate for instruments like this has gone up with interest rates- a preferred stock yielding 0% until 2044 could potentially be worth as little as 5 or 6 cents on the dollar, whereas previously, it was worth 11-12 cents on the dollar in the near zero interest rate environment that we were in when AAMC was negotiating with Putnam.

Pulling this back into the operations of Altisource, I believe that Flagstar would have looked at the merits of Luxor's preferred stock case and decided that it wasn't enough of an issue to keep them from lending AAMC money.

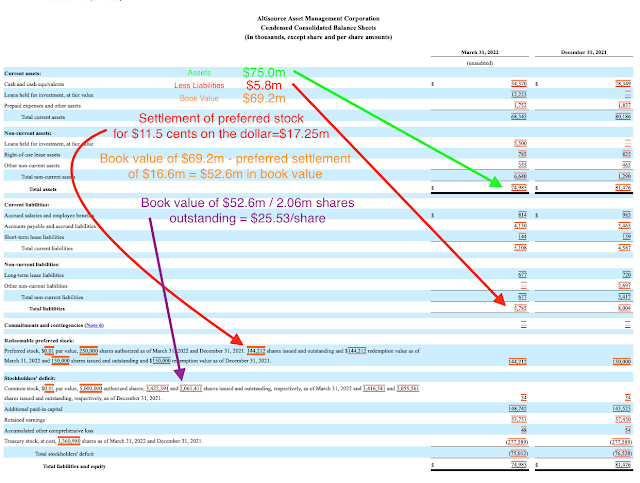

SIGNIFICANT Share Repurchases: Another essential item is that the company repurchased 286,783 shares of common stock from Putnam (a considerable shareholder previously that sued and SETTLED with the company over the same preferred stock that Luxor is in litigation with AAMC over). This repurchase represents just under 14% of $AAMC's outstanding shares. Not only did they repurchase a HUGE amount of stock, but they also were able to eliminate the "most favored nations" clause in their settlement agreement with Putnam from 2021. This significantly reduces the risk for $AAMC with a potential Luxor settlement. The company now has the freedom to settle for more than 11.5 cents on the dollar without paying previous preferred shareholders extra money.

Given this repurchase, if the company settles with Luxor on the same terms that it did Putnam, my estimate of adjusted book value is ~$24/share compared to the current share price of ~$20/share. If the settlement price goes down to 6 cents, then the book value would be roughly $28/share.

New Website Demonstrating The Future For the Business: Given all of these developments and updates, it is amazing what has been accomplished in such a short period of time! The company's

new website makes clear to me that the future of the company is in its alternative lending business and not in the $2 million that it has set aside to fulfill an OPTION to roll out

Forum Pay Crypto ATMs. These ATMs, despite the routing of crypto prices, seem to still have GREAT economics. Again, this option currently represents virtually none of the company’s assets, and IF the program gets up and running, the total allocation will be under 2% of the company’s assets. Keep in mind- if this materializes, AAMC company will NOT be taking crypto onto their balance sheet and taking a risk with the value of digital currencies. With a redesigned website that focuses on the alternative lending platform, I don’t think that much focus should be put on the crypto items for the company.

Risks:

*Not selling loans- One of the most important items for the company is to execute on forward sales contracts with REITs, insurance companies, banks, and the like. I have full confidence in the company doing this over time, as the CEO, Jason Kopcak, is very well connected in this space. I think that the higher-yielding loans that the company is originating should sell themselves, and as such, I don't view this as a huge risk. Especially when the company is a minnow in the ocean of these loans. It should be easy for the company to take market share.

If the company can not sign sales agreements, then the company will likely keep up its efforts to do so. I have no reason to think they won't succeed in this. Should that be the case, then the company will have high-yielding debt instruments on its books, much like Sachem Capital, Manhattan Bridge Capital, and the like carry on theirs. Hardly a bad scenario.

*Impairment of loans on the books: with interest rates going up, the company did take a temporary write-down of $1.56 million on their loan book of more than $100 million. This was due to interest rates rising, and the present value of the loan being reduced. This was NOT because of an impairment of the actual loan in terms of it being in foreclosure. However, there is a risk that foreclosures could happen, which could impair the company's collateral. Though, I think that this is mitigated by their underwriting.

*A recession that sees real estate prices fall by more than in 2008. As noted above, a severe recession could impair some of the loans that AAMC has on its books, but, I think that risk is mitigated by the company originating loans that have lower LTVs and that they are also ramping up as housing is going down. This could be a great way for them to have a more stable book of business than others.

*Fraud- If the company commits fraud, then the buyers of their loans would have a case against them. However, having personally gone through the underwriting process, I believe that the company is operating in an ethical manner, that is very thorough. So, again, I think that the risk is mitigated.

*NYSE De-listing- the company had been suspended from trading for a few months because they didn't have an operating business. Though that has been fixed, and the NYSE has given AAMC until November of 2023 to get in compliance. Given the progress that has been made at the company, I am not concerned about this. It seems like the shareholders that minded a de-listing sold in the spring of 2022 when the share price was beaten down to ~$10/share. It also seems that a lot of those shares were sold to new 13G filer Theodore King, who does not seem to have a problem investing in companies that could trade Over The Counter. King owns more than 10% of the company.

*Litigation- the company could get a negative judgment in the preferred stock suit with Luxor. Though, given the company's history of prevailing in litigation, and settling the majority of the preferred stock claims, I am not worried about the case that is having oral arguments this Thursday, December 1st. Key to note is that Luxor is not even arguing that the preferred stock conversion should be able to bankrupt AAMC. Luxors arguments seem to be that AAMC should have redeemed SOME of the preferred stock back to Luxor, even though the documents clearly say "all but not less than all". Additionally, Luxor doesn't prescribe any sort of amount that the company should redeem. The arguments seem disingenuous, and, frankly, seem to be biding for time.

Valuation: The bottom line is that a company with executives that are this shrewd with capital allocation and business formation deserves MORE than a valuation equal to book value. It seems perfectly reasonable for them to grow into a multiple of a company that bears their name: "asset management."

To this end, A REAL business is emerging. As of the end of Q3 company put together a portfolio of ~$100 million in loans. I believe that this amount has continued to grow since that time. The company noted that it has even received payoffs on some of its loans to the tune of more than $13 million.

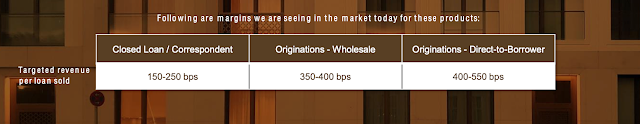

On the revenue side, the company should be able to originate and sell $600 million in loans per year, with an average spread of 350 bps- which comes to $21 million in origination-related revenues. Add in interest from the loans they carry on their books until the sale of about $10 million a year- this assumes ~$100 million lent out at an average rate of 10%. So, total revenue of $31 million.

On the expense front, I think that a year from now, legal expenses will be pretty de minimus since the Luxor litigation is probably coming to an end, and the company is also towards the end of its legal spat with its ex-CEO (where the company is in GREAT shape and should get some money). I also think that professional fees and acquisition charges will come down a lot as well, as I am under the impression that these were due to acquiring some of the loans on their books now and are not part of the fees that will be ongoing with the origination platform. So, call corporate overhead and all that $6.5 million a year. The company will pay interest on its warehouse line- let us assume that is about $2.75 million a year (5.5% on $50 million). Total expenses will be ~$9.25 million.

Pretax earnings should be $21.75 million,based on these numbers. Given the complexities of tax structures and such in the US Virgin Islands, where $AAMC is based, I will let you figure out the tax rate that the company pays. However, if we use some generalities here and assume that the company is paying out 17.5% in taxes, we get to $17.94 million in earnings OR with just under 1.78 million shares outstanding, just north of $10/share in earnings...

_______

What does this estimate NOT include? A few things- because I am trying to keep things simple. I think my estimate is a pretty “average scenario” where if you would, say, adjust SG&A costs up, you could reasonably take loan originations/sales as well as interest income up to more than offset the cost increases.

*Loan charge-offs. First, the loan BUYER will assume the risk unless AAMC does something fraudulent. Having worked on 2 loans with them- I don’t see that happening, given how they verify all the different aspects of the borrowers and collateral. There were items that they asked for that I have never provided to a bank in the nearly 20 years that I have been doing residential real estate. Also, given the lowered LTVs that the company is underwriting, I don’t think there will be many issues here- not to say they won’t be there- I just am not using them for my back-of-the-envelope math. Also, note that Manhattan Bridge Capital ($LOAN) has never had a single loan go into foreclosure, so this is not unheard of in the space.

*New lines of business. The company could well earn more money by servicing loans or, as mentioned on their website, asset management.

*Origination volume that becomes more than a few hundred basis points of the total market. If the company could get just 2% of the originations for the market they are in, this would be the story of a lifetime. Remember that $600 million a year in originations is a drop in the bucket when Corevest is doing single securitization deals over $300 million!

*Significant growth of overhead. The company has indicated that it will NOT be significantly increasing overhead. Previously, it had kept its loan originators in India employed so that the company would be ready to roll when operations were up and moving, as a result, a lot of those costs are baked in. While AAMC is increasing its headcount in India, keep in mind that these low-cost workers underwrote billions of dollars in real estate transactions for Front Yard Residential. They are efficient and provide the company with a lower cost profile than many others in the space here in the States. As a result, AAMC should be able to generate wider margins than its competitors.

*Shifting of product mix. Currently, it is anticipated that the company will be averaging 350 basis points on its originations- what happens if DSCR loans that generally give the company a more extensive spread take up a larger piece of the pie than, say, Correspondent loans that don’t provide as much spread?

*Declining interest rates. If inflation continues to fall, then ideally, interest rates will also fall. If that happens, then the loans on the company's books will be worth more in principal because they were originated at higher rates. It greatly helps that company seems to have adjusted its lending to the higher interest rate environment that we are in.

*New financing lines or methods for the company to grow with. In the company's most recent investor call, Jason Kopach indicated that Altisource was looking at a new warehouse line to increase borrowing capacity. This would increase the number of loans that could bear interest or, more specifically, be sold in accordance with the sales model that the company has outlined. I have also suggested that the company utilize the same sort of baby bonds that Sachem Capital has issued several series of.

*Tax rate analysis. Keep in mind- I assumed a 17.5% tax rate for the company, which is probably high given it is a company based in US Virgin Islands (with a small NOL). Because of this structure, the company can take advantage of better capital allocation options for shareholder capital return than its competitors. Where a REIT such as Manhattan Bridge Capital or Sachem has to distribute out 90% of its income, AAMC is not under that obligation and can be more nimble with returns of capital via spin-offs, dividends, or share repurchases (that is, has a recent history of doing!).

*Accretive capital allocation. As mentioned several times, the company has repurchased its shares. I think that this shows the company gets capital allocation. I will also note that the company has a significant number of these shares held in treasury, which to me is very exciting. If the stock gets to an attractive price where issuing the shares would be accretive, then the company has that optionality. RCI Entertainment ($RICK- check out the capital allocation slide on page 14 of this presentation for reference) is a company that has done buybacks and issuance very successfully as of late, in addition to all the names that everyone already knows such as Auto Zone ($AZO), Teledyne, and the like.

Keep in mind that the Putnam shares that were recently repurchased for $10/share had been issued a little more than a year earlier for a price in the $20/share range. This, in effect, had an impact of LOWERING the settlement cost with Putnam. It's one thing when a company talks about capital allocation and share repurchases- it is another when they actively deliver.

All this, together, basically means that I know I will be precisely wrong on some or perhaps even all of the points in my valuation. However, I believe I will be roughly and directionally correct when looking at the valuation in aggregate.

_______

In conclusion, I am coming to ~$10/share in recurring earnings on a company that has repurchased many shares, has insider ownership, is an exciting business, and is currently trading for ~$20 a share. What's that worth? I am not sure, but probably a lot more than the shares are selling for right now.

If you want to get some of this info directly from the horse's mouth, I strongly suggest you check out this presentation paired with this recent conference call. It is worth a listen while you are driving or exercising. If reading a transcript is more your speed, try this link from Seeking Alpha.

Disclosure: I am long shares of $AAMC. This is not investment advice. Do your own research. I have used the company's loan products to test them out as part of my "scuttlebutt" on the company. I have not and will not receive compensation of any kind for this writing.