Thryv is a bit of an oddball... first, it’s a melting iceberg of a business- The Yellow Pages. There is also a SaaS business that no one seems to have discovered. I know, I know... Dex Media was a value play that ended up going bankrupt back in the day, so hear me out hear the company out in their various presentations. They do a really good job of laying out the case for the company, both good and bad. I think that the 2 most interesting presentations, are the most recent- the Global TMT Virtual Conference and the conference call for the last 10Q (transcript). Their Investor Day Presentation is also a good source.

For the "TL;DR" crowd, this company is actually 2 companies- 1 that is declining, the other is potentially worth multiples of the present valuation. There are several catalysts at hand, and the incentives all seem to line up. Plus, this is run and controlled by very sharp, very rich, and very well incentivized people. The current price is $13.50 and the market cap is $420mm. I think that it could be worth multiples of that. The catalyst that is in the nearish future is the spinning off the SaaS business. Management has said will occur, and that John Paulson is pushing for it to happen in the next year.

Two Businesses For The Price Of One

Thryv is 2 separately run businesses- the first, being the “shrinking iceberg” that is the Yellow Pages (doing over a billion with a “B” in revenue ~$1.1bb in the trailing 12 months) and the second is the SaaS business- Thryv (more on this, later, after talking about YP and management). The YP business should see revenue declines in the low 20%’s. This lines up with revenue declines for dial up ISP customers and such- which while certainly NOT the same, the scenarios do rhyme, as it is reasonable to think that the same people using dial up, use the Yellow Pages. A geographic search of Google Trends seems to validate that, when comparing to dial up usage.

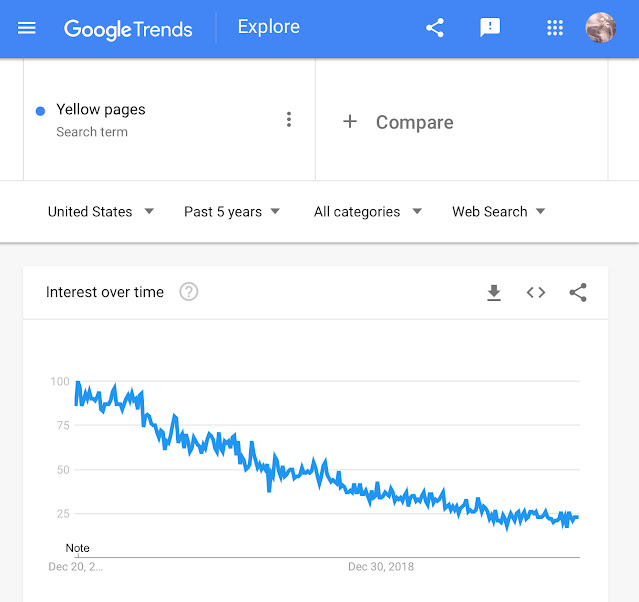

Also, looking at the declining popularity of the Yellow Pages in Google searches over the previous 5 years... it seems like revenue declines in the low 20%s is actually a decent guess- historically, that seems to be about the decay rate, in terms of google searches- so, maybe that guess is even cautious? Who knows. But, it is representing a HUGE amount of revenue, and is on a variable cost structure. So, that is GOOD for a melting ice cube. Rather, iceberg.

Given that the company has a decent debt load, it takes the large amount of cash flow generated from the Yellow Pages business, and generally uses it to pay off debt- not only that, but, they are REQUIRED to put 100% of excess cash towards debt repayments, per their credit agreements (this is in their S1, page 138). Keep in mind, the majority of debt holders, also own the vast majority of the equity. So as to say, it seems that even though there are 4 billionaires controlling about 91% of the stock (and a lot of the debt) there isn’t much of a way for management to blow the money on something stupid and potentially company wrecking. I DON’T think this would happen, because of the credentials of management, but that backstop is kind of nice, just to make things a bit more predictable. Check out the wording of the pre-payments.

The company still has 3 years until the maturity of their debt, of which, the vast majority should be paid off by that time. I think it is a safe bet to assume that they will be looking to reduce the interest rate in the future, either through refinances, or, other creative measure- such as a bond offering. The cash flow from last year alone was enough to pay off ~2/5 their long term debt obligations (as of 6/30/2020).And, this company actually makes money (they lost money in Q3, due to a pension contribution- more on that later)... check out their Income Statement and Cash Flow:

Massive amounts of depreciation. SG&A going down as the revenues from the YP decline, and cash flow that is about 1/2 the market cap of the company.... Seems like a compelling play, just based on that. So, the bottom line, is that all this operational cash flow will be going to pay off debt in an expeditious manner. As this happens, the interest they pay, will go down too!Management

The company is run by Joe Walsh. He owns over 6% of the company via call options. So, it's fair to say that he wants to see the stock do well. Previously, he built a competitor to the Yellow Pages, sold it to a larger company, then grew it more, then sold that to a public company. Then he joined a company called Yellow Book and grew that to be a $2bb company via acquisitions- they combined that with the Yellow Pages in the UK and went public. Then started a board advisory firm. after that, he was involved with a public company called Cambium, that was taken out by a private equity firm... so, he seems to really know his stuff. When the Yellow Pages was in bankruptcy, via DexMedia, he was brought in by the debt holders, to make something work. Since then, he has guided Thryv to where it is today.

Check out the Cambium Learning chart, just before the buyout for 14.50 a share...

More on Joe Walsh, here and here.

SAAS!!!

HERE IS THE KICKER... Thryv also has a Saas business, called “Thryv.” Interestingly, they used their dying platform from the Yellow Pages, to get users on the white label SaaS business. To me, THAT is really interesting and shows a VERY creative way to use and monetize assets of an old business, and keeping development costs down. In the instance of other companies, such as Sears or virtually every local newspaper out there, there was never enough execution. But Thryv has a legit customer base of approximately 45,000 users, who are paying well over $200/month for services. Per management, this business is already profitable. Through diligent selling of their workforce, the company literally got 10% of the Yellow Page customers (and are still trying to get more, look on their webpage), on to the Thryv platform. Walsh refers to this strategy of “hunting in the zoo” for customers. If you have yet to check out the software- it is absolutely fantastic. Actually, it is PERFECT for the home services sector. The program is SUPER simple, and quite effective. It won’t scare anyone away with too many options, settings, or frills that no one needs, or wants- which is key. SaaS platforms such as Service Titan and CoConstruct (which I use, and love) are both great, but for a lot of smaller shops, they are just waaaaayyyy to complicated for what they need. And that is how you get past a lot of resistance for small businesses that don't have the time to learn a complicated system. Simple is the key, and Thryv is simple.

Something else that I find neat thing about Thryv, is that a hair stylist, plumber, veterinarian, or even a school tutor could use it. It is a very versatile software! As an antidote to this, I am buying 5 townhouses off of an investor I know, and his son owns a franchised floor epoxy coating business. So, I reached out to the son, to see if he uses any sort of CRM. Turns out, and I swear that I am not making this up... He uses Thryv! Also, he LOVES it- only issue was a QuickBooks compatibility issue a few months ago (which, is pretty par for the course with anything QuickBooks related, in my experience). The issue got resolved in a few days. Other than that, he loves it. So, that was a cool data point of sorts, for me.

Also, on recent calls, the Thryv execs talk about the great economics of dealing with franchises. Which if you think about it, is a beautiful model. Not only are you not having to sell the software to new businesses, you have a totally separate company that is out trying to grow their business, and in turn, is helping Thryv grow theirs! That is a unique type of operating leverage that I don't think many people, or businesses think about.

So, given that I like Thryv, and so do 45,000+ other people, what does Thryv do?

*SEO optimization, and makes sure that a company’s hours and other details, are consistent throughout the internet to around 60 different sites... Small things like this, make a HUGE difference for businesses.

*Billing

*Contracts

*Conversation Tracking

*Scheduling

*Website Support

*CRM database

*Estimates

*Payments

*Appointments

*Marketing Campaigns

*Follow ups for reviews for various sites, that go out for distribution

*Payments*- The company just introduced Thryv Pay. This is a great way for small businesses to take payment. Key is that it is built into their software- automatically connecting with, and reconciling to QuickBooks. It’s early on in the product's launch (coming online in the past few months) but the company is already reporting lots of transactions, has loads of signups, and- just look at the addressable market they have!

Fees are almost identical to companies such as Square, and if someone pays the vendor with a credit card, there is the option to add fees onto the transaction. Additionally, the money will be in the vendors bank account the next day. This is HUGE for many small businesses.

Thryv also has different verticals where they are going- such as legal, and the like. Really compelling stuff...

One last thing... Thryv's SaaS business is PROFITABLE. While not currently separated in SEC filings, I think that sort of reporting will be coming soon. Management has said on conference calls that the SaaS business is profitable- this is something that is not the case for many SaaS businesses that have sky high valuations. Also, the SaaS business and the legacy Yellow Pages business are run as totally separate entities, so, the segregation of their operating results will be easy to show, as the company looks to monetize Thryv in the coming quarters/years.

OH!? And guess what? Their churn rate? It’s about 2%. That’s pretty low on the face of things, but think of the stickiness of the customer base, especially when it is made up of the RIGHT customers. As mentioned earlier, I use CoConstruct for my business. A new, better, and cheaper software could come along, and there is no way that I would switch- it would be WAAAYYY too much of a pain, and would take forever, for not much better results. Retraining the people I work with would take forever, and be demoralizing. For my business, this would be about a hundred times more of a pain than switching from an iPhone/iPad/iMac/Apple Watch/Apple TV to an Android setup. By extension, we know what the market thinks about the stickiness of the ecosystems that AAPL and GOOG provide- and it makes sense, because there are long articles on HOW to do the switch- and thinking of that would probably give a person a hint of anxiety. Seems like a lot of work... There are even examples of governments using inferior softwares for a very long time, because switching is a pain. So, think of all these examples as a corollaries for small businesses and Thryv. So as to say... I doubt there will be people switching away from Thryv, once they get onboarded and use it for any length of time.

When looking at the growth rate for the Saas business, things are a bit deceiving at first. The company was originally selling to whoever would sign up. They admitted that didn't make for a good setup, because it made the churn so high. It also keeps referrals down, if people aren't happy with their software. It uses up valuable employee mind power, and time, too. So, they refocused on businesses that have multiple employees, and are in industries they feel are good to work with. The software simply is not that great for the type of business that is "a guy and a truck." It needs more working components than that to really provide value for a business. As such, they are really looking to set people up for success.

I recently did a product demonstration with one of the Thryv team members and this is exactly what the sales person asked me FIRST. They wanted to know my business setup, because they wanted to make sure that they were a good fit for us. While I already have software that I use, I work with contractors that will be purchasing the software soon- because they see the value in it, once it is shown to them.

Now that there has, in essence, been a "flushing of the system" where Thryv purposely lost and didn't sell to certain types of businesses, It seems apparent that the growth trajectory of Thryv will start again, making the situation even more compelling. The company can already see its EBITDA margins increasing. With COVID, software solutions are all the more important for small businesses, and small businesses are starting to really see that they NEED these solutions.

Reducing Pension Liabilities

From the most recent 10Q, in the “subsequent events” section:

They are working to shed themselves of pension liabilities... while not huge in the grand scheme of the SaaS valuation, and me not wanting to focus on the pension, I do find this really interesting. Just that they are working to get rid of this is good, in the sense that they are paying attention to all aspects of the business, and actively shedding those liabilities. We should see in the next 10Q how much of the liability was shed. It should be material though, as they did disclose the matter in their subsequent events.

Subleasing Office Space In Dallas Fort Worth

Due to COVID, the company went to a “remote first” setup. As such, they impaired their office's value...

BUT, they still have a lease in place. Keep in mind that they have been paying rent, and as they continue to pay it, their earnings and cash flow should be roughly the same as they had been historically... BUT. They could sub lease it - in fact- they are trying to. Granted, office space is plentiful now- but with organizations like Oracle moving to Texas- this seems like to the THE PLACE you would want to be subleasing space, if you had to be in that spot. Being close to the airport in Dallas ain’t a bad spot, either...

So, while it may not be a catalyst- it could certainly shore up earnings- and more importantly, help get rid of more debt and interest payments. Formerly, the lease payments were a straight up drag on net income- they shouldn't be as much, net, in the future. Let’s say that they were paying $15/ft/year for the lease- that’s $5.1mm of a hit to the income statement. Let’s add in some for utilities, repairs, and things like that. Maybe they had security guards that they don’t need now, that they are work from home first. So, let’s round that $5.1mm up to an even $6mm.

Then, assume that even with the glut of office space, they can rent it out for half what they are paying, and eliminate the $.9mm of misc office expenses. That comes to $3.45mm in additional income that they didn’t have before. Sure, it’s not HUGE, but it’s something. Feel free to use whatever multiple you want, if you throw a 20x multiple on that (20x just as an example), then that represents a nearly $70mm uptick for the stock... that’s a hair more than 20% upside. Not bad!

Effects Of The Pandemic

In addition to working from home for a lot of the employees, the company also issued pandemic credits to help some of its customers. While they probably won’t be getting 100% of these revenues back, it will certainly buy them goodwill, and the additional revenues should go straight to the bottom line (and even better, to debt repayments).

Valuation Ownership, And The Like

First- why is this cheap?

THRY just did a direct listing on the Nasdaq as they didn’t need to raise capital. Seriously- that's kind of the purpose of the direct listing that they did kind of counter intuitive for a Saas business, right? Aren't they always raising capital?! Anyway, they couldn’t talk about the company during this time- so there were no road shows or conferences like there are, now. COVID also put a damper on these shows. But with the company being more "free" to talk, they are, and the story is starting to get out.

In addition to people just not knowing about the story- as I mentioned early in this write up, the company's true worth is obfuscated by there being 2 companies in 1. John Paulson explains:

Speaking of John Paulson, lets examine the ownership of the company:

*Only about 9% of the stock is really out there, in “float.” So who are the holders? A bunch of billionaires.

~60% is owned by Affiliates of Jason Mudrick

~15.5% is owned by Affiliates of Goldenree- Steven Tananbaum

~10.5% is owned by Affiliates of John Paulson.

~6% is owned by Yosemite Sellers Representatives- Stephen Feinberg

This brings the total ownership of billionaire hedge fund managers to in excess of 91% of outstanding shares... that not only makes for a pretty tight float- but also an ownership structure where the major owners are well connected, and wanting to see this do well. They have the control of the entity to make it happen.

On top of that, CEO Joe Walsh owns 5.96% of the company via options... Sure, there are some warrants out there, but, that isn’t enough to really think about. So he would love to see the price shoot through the roof.

CATALYST: SPLITTING THE COMPANY

First and foremost, CEO Joe Walsh, going back to his Cambium days, seems to know a thing or two about selling companies... He has also stated that they are running the two businesses totally separate, and that they could split the company in two, tomorrow. Just in case you missed the John Paulson video earlier- did I mention that a 10% holder of the stock- billionaire John Paulson of subprime mortgage shorting fame, is calling for splitting the company in the next year?

To bolster this idea, there was recently a large re-pricing of stock options for the company’s executives. In my mind, this makes the monetization of the SaaS business at Thryv even more eminent. Check out this tweet, for reference, and explanation.

Given the situation, as it SEEMS to be unfolding, it is my hypothesis that the plan was to wait to monetize the SaaS business, and to grow it more for a few years. That being the case (management said said it was on the call) then there were a set of assumptions made between management, and the board. If the plan changes mid game, wouldn’t it make sense to make it so that the executives were incentivized to not only change the plan, but to reward them for changing the plan, mid game? Repricing the stock options certainly aligns with this scenario- as the additional money represented by the repricing is pretty significant- well in excess of $1.5mm dollars, but as a fraction of the stock option vesting price? it's nearly 1/6th... that ain't chump change. Additionally, Mudrick was involved in a company called GoGo, and the same sort of option repricing happened RIGHT BEFORE the company announced that it was exploring strategic alternatives... not exactly the same scenario, but, it certainly rhymes.

As John Paulson noted in the conference call (here is a video of JUST the Paulson part of the call): Hubspot (HUBS) gets a premium valuation to THRY. Of note, HUBS only has about 2x the number of customers that Thryv does, but also gets about 50x the valuation...

So What’s It Worth?

With about 31 million shares outstanding, the company is valued at $13.50/share, or, a market cap of ~$420 million. John Paulson suggested in the last conference call, that the declining business was worth about 2.5x EBITDA... which seems pretty standard for declining businesses like this. On the same conference call that this was mentioned in, the Joe Walsh even said that when they were valuing the YP business, that they used very conservative DCF numbers. Just look at the amount of cash flow this company produces!

So, when adding the long term debt back in to the equity (tho, not all the liabilities, because the pension should be going down due the subsequent event discussed earlier) this is about the current market cap of the whole company... So, call this a break even based on the Yellow Pages valuation- with the SaaS business thrown in for free.

Valuation Of The SaaS Business

*A recent valuation for Monday.com (another software that I use, and love) who boasts around 100,000 users, came in at a whopping $2.7bb. A year before, their valuation was $1.9bb, when they had 80K organizations, and about a year before, had 35K... Based on what I pay for Monday, and the setup it has, it is a kissing cousin to Thryv, in terms of revenue generation. I think that Thryv has a platform that can scale more than Monday, based on my experience with both softwares.

*Airtable, around 2 years ago with 85K customers, was valued at $1.1bb.

*Notion was recently valued at $2bb with 4mm users.

Based on this, and everything you already know about SaaS valuations- you can tell that the real kicker with Thryv is the SaaS business. If you put a 5x multiple on the revenue, that represents an additional $625mm of market cap. If you put a 10x multiple on revenue, which is where numerous companies like this seem to get valued at, that’s $1.25 bb in additional market cap. At 5x revenue, the share price would be ~$33.60/share, and at 10x, the share price would be about $53.80/share... compared to a current share price of $13.50. Even if valuations crater for SaaS businesses, I don’t think a double in the equity price is unreasonable- especially because Thryv, the software, actually makes money- unlike others that constantly need to raise capital to grow, such as Hubspot (HUBS). By the way, HUBS is presently valued at over 20x sales. Granted, there are differences in the companies... but, these various points do a pretty good job of showing what the worth of Thryv could be, going forward.

Add in the repricing of stock options, that I think were done to incentivize the executives at Thryv to monetize the SaaS business sooner, rather than later, and this the most compelling equity situation that I can think of.

Disclosure: I am long THRY.

No comments:

Post a Comment